Contents

The Nash exchange has been described as hybrid DEX using off-chain order matching and trade settlement via a series of smart contracts. Qurrex, on the other hand, no longer seems to have a functioning website, or be a functioning hybrid exchange for that matter. Given the newness of hybrid crypto exchanges, traders are urged to proceed with caution, especially if engaging in arbitrage. Let our team of quant developers help you build your proprietary algorithms. They have vast experience in implementing market making bots and algorithms for investment banks, brokerage firms, crypto exchanges, and hedge funds.

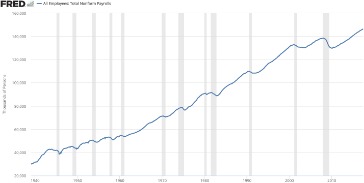

Before we request data from Alpaca, let’s initialize a dictionary to store price values. Plotted here is the hourly price comparison between BTC/USD and the conversion price using BTC/ETH and ETH/USD. We can see that there is almost always a price discrepancy and that they can sometimes be very large. Yield curve control (“YCC”), also sometimes called interest rate pegs, is where bond yields are set by the central bank. In our crypto guides, we explore bitcoin and other popular coins and tokens to help you better navigate the crypto jungle.

Upon completion of this article, you will not only better understand how arbitrage works in the cryptocurrency market, but you will be provided the tools to execute an arbitrage strategy of your own. In currency markets, the most direct form of arbitrage is two-currency, or “two-point,” arbitrage. This type of arbitrage can be carried out when prices show a negative spread, a condition when one seller’s ask price is lower than another buyer’s bid price. This circumstance is rare in currency markets but can occur on occasion, especially when there is high volatility or thin liquidity. Market prices, data and other information available through Alpaca are not warranted as to completeness or accuracy and are subject to change without notice. This is largely because one cannot generally take traditional investing concepts and apply them successfully.

The Best Alternatives to Crypto Arbitrage

Select the https://topforexnews.org/ where you have a trading account and the one that supports api based trading. In this example I have used the WazirX exchange as I have a trading account in this exchange. Here is an overview of the different steps to implement a triangular arbitrage trading algorithm.

Prospective investors must not construe the contents of this website/application as legal, tax, investment, or other advice. The use and development of exit strategies/plans by users of the Shrimpy app are not the responsibility of Shrimpy, its affiliates, or partners. Users are responsible for the creation and execution of their own exit strategies/plans and if they have questions regarding investments in crypto assets, they should consult with a financial professional.

In practice, Triangular Arbitrage refers to a trading opportunity when there’s a discrepancy between the rates of three currencies such that they do not exactly match up. One can then place simultaneous trades to buy one currency and sell another, both trades being conducted in a third currency, and benefit from the discrepancy in exchange rates. Identify opportunities by looking for a difference in pricing across exchanges.

Drawbacks of Arbitrage Trading

You might carry out a https://forex-trend.net/ to get a bigger return for the exchange. You exchange British pounds for yen at one rate, convert it again to euros, and then covert it back to the original pounds to net a profit. Thereby, the Japanese trader will earn profits worthJPY 24,117.647through triangular arbitrage on an initial investment worth JPY 50,000. The reason for dividing the euro amount by the euro/pound exchange rate in this example is that the exchange rate is quoted in euro terms, as is the amount being traded.

Lastly, we sell our ETH/USD since it is the more expensive currency. We check whether a quote is valid or not by finding its status code . This function updates the dictionary with the most recent values of each asset. Find the approximate amount of currency units to buy or sell so you can control your maximum risk per position.

- Shrimpy and its partners are not financial advisors and do not own or guarantee the success or failure of ANY exit strategy/plan displayed or developed on the Shrimpy app.

- Some exchanges set a rate limit which does not allow repeated api calls.

- The offers that appear in this table are from partnerships from which Investopedia receives compensation.

- Currency pairs are two currencies with exchange rates coupled for trading in the foreign exchange market.

- Triangular arbitrage is a commonly known technique for exploiting price differences between assets to try and make a quick and low-risk profit.

Triangular arbitrage works by taking advantage of differences in the cross rates between three currencies. In this scenario, a trader could convert currency A into currency B, and then convert currency B into currency C, and finally convert currency C back into currency A. If the cross rates are such that the conversion results in a profit, the trader could then repeat the process to generate a profit from the difference in the cross rates.

Latest Articles

Additionally, it has become even more rare in recent years due to high-frequency https://en.forexbrokerslist.site/, where computer algorithms have made pricing more efficient and reduced the time windows for such trading to occur. FXCM is a leading provider of online foreign exchange trading, CFD trading and related services. Commission-Free trading means that there are no commission charges for Alpaca Securities self-directed individual brokerage accounts that trade U.S. listed securities through an API. You should know that the use or granting of any third party access to your account information or place transactions in your account at your direction is solely at your risk. Given the need for quick quotes and trade orders, a strategy like this can really only be implemented with API trading services – where Alpaca excels.

Surely, if you encounter any problems in this process, or you have a profitable strategy to share, please reflect in ISSUE, we will try to respond in a timely manner. The second thing you should do is double check that the exchanges provide the tokens on the same blockchain. Sometimes cryptocurrencies will move from one blockchain, for example when EOS moved from the Ethereum blockchain to its own Mainnet, creating a situation in which there are two different wallet address formats. You connect our platform to your trading accounts on crypto exchanges. All your balances are always on the exchange side, so you always have complete control of your funds and can ask for a withdrawal on your exchange whenever you want.

We write about digital assets, liquidity, defi, leading cryptocurrencies like Bitcoin and Ethereum, crypto exchanges including CEX like Binance, Coinbase or DEX like Uniswap, quantitative algorithms like arbitrage, web3, and blockchain. Reports the average GA arbitrage profit with respect to direct exchange rate and the average number of exchange rates, as well as their standard deviation and median, for the entire sample and for two subsamples . Simple arbitrage is the buying and selling action we described in our previous examples in this article. Simple arbitrage buys and sells the same crypto asset on different exchanges as quickly as possible to take advantage of the inefficiencies of pricing across exchanges. LOS 8 Identify a triangular arbitrage opportunity and calculate the profit, given the bid-offer quotations for three currencies. The process of triangular arbitrage is exactly that of finding and exploiting profitable opportunities in such exchange rate inconsistencies.

Just like any other arbitrage strategies, the market will return to the equivalent level once traders start to exploit the pricing inefficiencies that are present in the market. These opportunities are therefore often around for a very short period of time. Hence, speed in identifying such opportunities and the ability to react quickly are needed to effectively profit. Correlation between GA arbitrage profits and number of exchange rates in each sequence with liquidity and volatility indicators. GA arbitrage profits and number of exchange rates in each sequence. This article will focus on a few of the most simple arbitrage opportunities available in the market.

Rise of the Machines: Algorithmic Trading in the Foreign Exchange Market

To shorten the computation time and to reduce the number of currencies in the final optimal sequence , we make some adjustments. First, given that our initial currency is 5 and the final currency is 2, we sequence, we remove of the sequence all the currencies located from this position, e.g. the chromosome becomes . Similarly, if the initial currency is located within the sequence before the final currency, we would remove from the sequence all the currencies located before the initial currency, e.g. the chromosome is transformed into . Finally, if the sequence is such that the same currency is selected in two or more positions, we remove all repetitions, keeping only the first one, e.g. the chromosome converts into .

Basics of triangular arbitrage

Three ticker prices are required simultaneously from the exchange to perform the triangular arbitrage. Some exchanges set a rate limit which does not allow repeated api calls. In such a case the api might throw a RateLimitExceeded exception. This can be handled by using a 1-second sleep timer between the api calls.

Cryptocurrency markets and exchanges are still in development, and more arbitrage opportunities exist in such markets relative to the traditional currency markets. The nature of foreign currency exchange markets limits the price discrepancies between different currencies to a few cents or even to a fraction of a cent. Therefore, the transactions in a triangular arbitrage opportunity involve trading large amounts of money.

An arbitrage trading program is a computer program that seeks to profit from financial market arbitrage opportunities. Moreover, KuCoin provides the transaction data of level 3, great matching engine, and the commission discount specially offers to the API customers, which could greatly reduce the disadvantages of the trading operations. At the same time, we offer the sandbox environment as the data testing support to avoid the risks. For even more accessibility Trality has now partnered with Binance, the world’s largest and most trusted cryptocurrency exchange, to offer the Trality Wallet. For example, in 2019, Coinbase Pro hiked their fees by 200% for traders who they deemed to have “low volume.” Maker and taker fees both increased significantly in the general overhaul, too, leading to frustration.